-

Standard Project Report Biomass

0Original price was: ₹2,499.00.₹1,499.00Current price is: ₹1,499.00.In this Report, we're sharing detailed information on Project Cost, Funding Pattern, Operational Cost, Net Margin, Payback Period, Project IRR, Risk Points, and Subsidy Benefits. -

Startup India Registration (Haryana)

0Original price was: ₹10,000.00.₹7,500.00Current price is: ₹7,500.00.Available on backorder

Startup India, launched in 2016, offers tax exemptions, simplified compliance, IP filing benefits, and access to government schemes. KIP further supports startups with subsidies, accounting services, GST registration, and guidance for business growth and stability. -

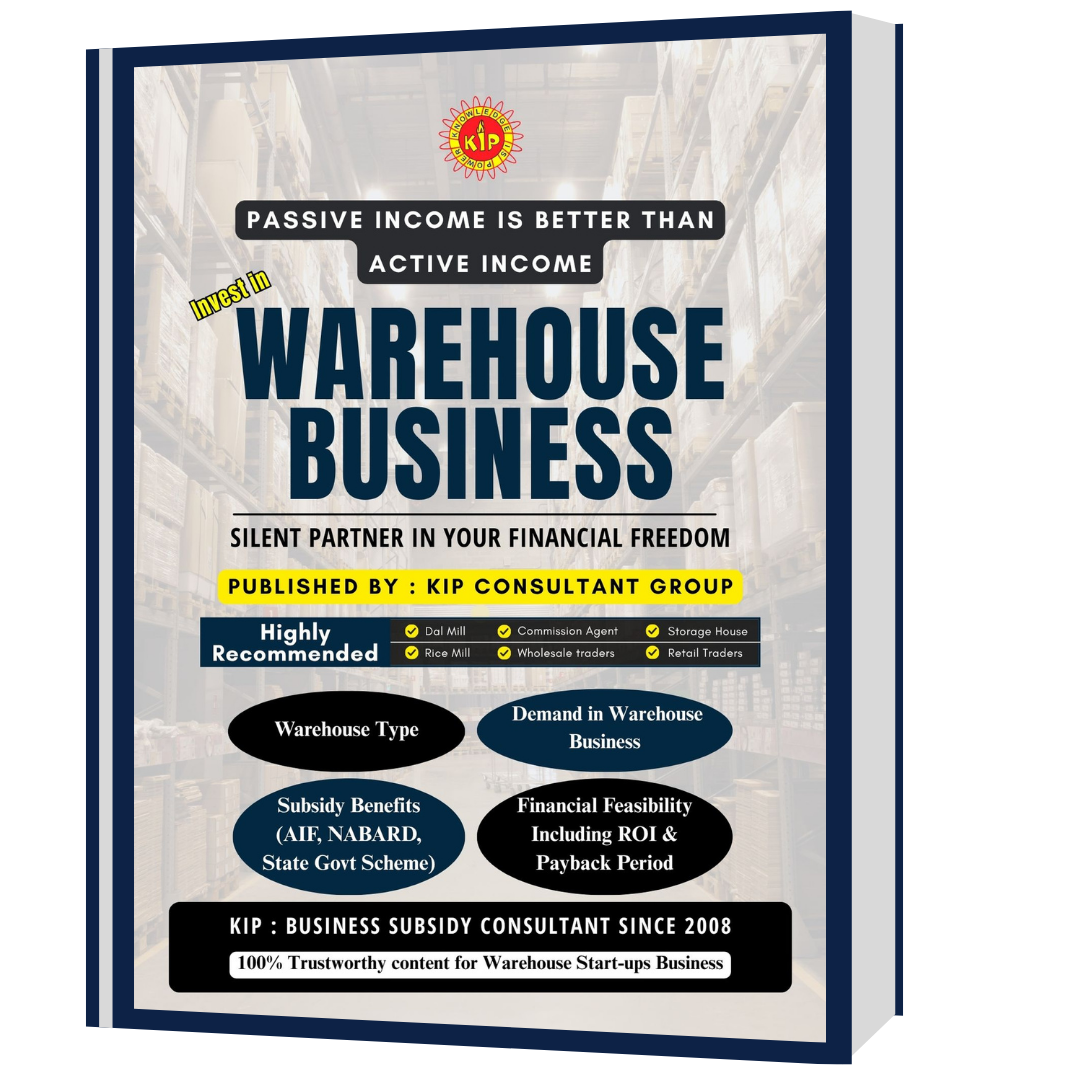

Telangana Agri Warehouse E-Book

0Original price was: ₹2,999.00.₹1,999.00Current price is: ₹1,999.00.Comprehensive guide to Telangana’s warehousing subsidies under Logistics Policy 2021-26, helping investors optimize costs and maximize returns. -

Telangana Commercial Warehouse E-Book

0Original price was: ₹2,999.00.₹1,999.00Current price is: ₹1,999.00.Unlock subsidies under Telangana Logistics Policy 2021–26 and maximize your warehousing ROI. A must-have guide for smart investors & entrepreneurs! -

Biomass Briquettes & Pellets Business in Uttar Pradesh Complete Guide to Biomass Business in Uttar Pradesh The Complete Guide to Biomass Briquettes & Pellets Business in Uttar Pradesh is a practical, implementation-focused eBook for entrepreneurs, MSMEs, and investors planning to start a biomass briquette manufacturing unit or biomass pellet plant in UP. This book explains how to convert agricultural waste into profitable biomass fuel, with guidance on subsidy support from the Ministry of New and Renewable Energy, benefits under Agriculture Infrastructure Fund, and incentives from Uttar Pradesh New and Renewable Energy Development Agency. Why Biomass Business Is Booming in Uttar Pradesh Uttar Pradesh is one of the best states for biomass pellet and briquette manufacturing due to: ✔ Abundant agro waste (paddy straw, wheat straw, bagasse)✔ High demand from thermal power plants & industrial boilers✔ Rising coal prices increasing biomass fuel demand✔ Government push for renewable energy & stubble management✔ Strong MSME and industrial ecosystem UP offers strong raw material availability and large fuel-consuming industries, making it ideal for biomass projects. What This Biomass Business eBook Covers Biomass briquettes vs biomass pellets comparison Biomass pellet plant setup & machinery selection MNRE subsidy & CFA guidelines UP state renewable energy incentives Agri Infra Fund loan process Biomass plant project cost, ROI & payback GST on biomass pellets (5%) & income tax benefits Key Benefits of This Biomass Guide ✔ Helps avoid costly project mistakes✔ Maximizes subsidy benefits in UP✔ Improves bank loan approval chances✔ Clear profit margin & ROI understanding✔ Reduces raw material and market risk This eBook acts as a step-by-step roadmap for biomass pellet manufacturing in Uttar Pradesh. Who Should Buy This eBook? ✔ Entrepreneurs starting biomass business in UP✔ MSMEs setting up pellet or briquette plants✔ Investors entering renewable energy sector✔ Traders supplying biomass pellets to power plants✔ Existing units planning expansion with subsidy support

- Image

- SKU

- Rating

- Price

- Stock

- Availability

- Add to cart

- Description

- Content

- Weight

- Dimensions

- Additional information

Biomass

Biomass  Warehouse

Warehouse  Msme services

Msme services  Diary & Milk Processing

Diary & Milk Processing  Agro-Base Business

Agro-Base Business  Business Registration

Business Registration  Tender Updates

Tender Updates

Home

Home  Whishlist

Whishlist  Checkout

Checkout  Account

Account