Sale!

Report Abuse

Biomass Financial Feasibility Report

Rated 4.00 out of 5 based on 1 customer rating

(1 customer review)

₹2,499.00 Original price was: ₹2,499.00.₹1,499.00Current price is: ₹1,499.00.

In this Report, we’re sharing detailed information on Project Cost, Funding Pattern, Operational Cost, Net Margin, Payback Period, Project IRR, Risk Points, and Subsidy Benefits.

SKU: Bioffr01

Category: 3 Biomass, Central, FFR Tag:23 AgriBusiness, AgriEntrepreneurship, BiomassBusiness, BiomassPellets, BusinessGrowth, CropResidueManagement, EaseOfDoingBusiness, Entrepreneurship, FarmResidues, GovernmentSubsidy, greenenergy, IndustrialGrowth, InvestSmart, MakeInIndia, MSMEIndia, NRIInvestment, RenewableEnergyIndia, RenewableInvestment, RuralDevelopment, SmallBusinessSupport, startupindia, StartupSupport, WasteToEnergy

Book Name:

Financial Feasibility Report for Biomass Pellets Business

About This E-Book

This e-book is a complete guide to understanding the financial feasibility of a Biomass Briquettes & Pellets Business. It provides detailed insights into project costs, funding patterns, operational expenses, and subsidy planning. Created by KIP, it equips you with the knowledge to make informed investment decisions and maximize profitability.

How This E-Book Will Help You

- Evaluate Project Feasibility: Analyze costs, funding, operational expenses, net margins, payback period, IRR, and risks

- Maximize Profitability: Learn how to leverage government subsidies and incentives

- Make Informed Investments: Get step-by-step guidance to confidently start or expand your business

- Unlock Financial Assistance: Identify available support from the central government via MNRE

Who Can Benefit

- New entrepreneurs and investors seeking high-demand, tax-free opportunities

- Farmers and agri-sector professionals managing agricultural residues

- Businesses in the Biomass Energy Sector or looking to diversify operations

- NRIs planning to invest in India

- Companies and individuals aiming for large-scale supply contracts or managing forest, agri, and horticultural residues

- Industries seeking coal alternatives or solutions to high energy costs

Topics Covered

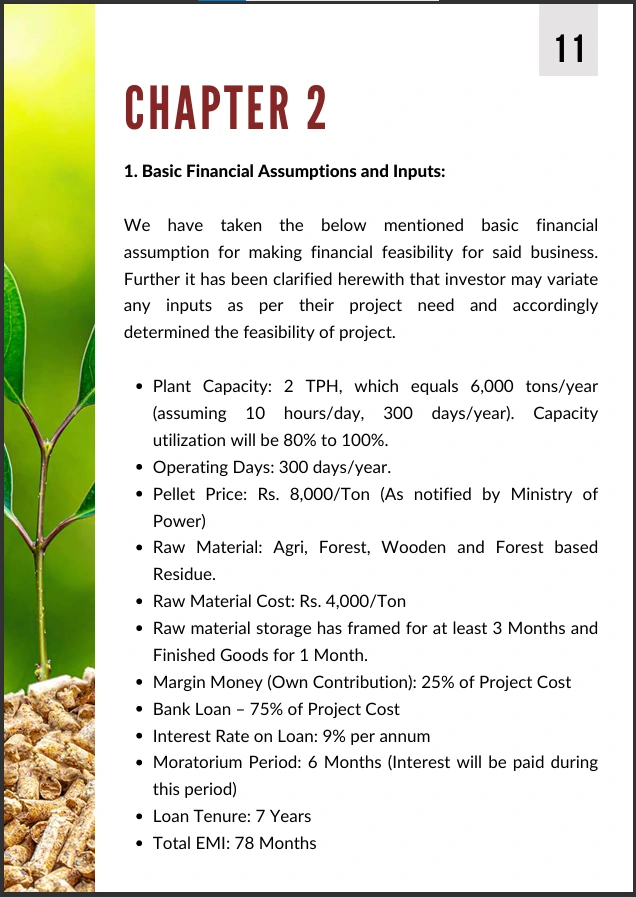

- Financial Feasibility: Technical, market, financial, statutory, and managerial analysis

- Project Cost & Funding: Capital investment, working capital, and financing options

- Operational Costs & Sales Projections: Raw materials, labor, electricity, and revenue forecasts

- Profitability & Risk Analysis: Gross and net profit, cash flow, and risk mitigation strategies

- Subsidy Planning: Central and state government incentives including capital, interest, tax, and employment subsidies

- Practical 2TPH Plant Example: Real-world scenario demonstrating investment and subsidy benefits

Why Download This E-Book

- Enter a Highly Demandable Market: Tap into a growing biomass sector

- Benefit from 100% Tax-Free Income: Enjoy full tax exemptions for the first 5 years

- Achieve Fast Returns: Project IRR up to 83% with a payback period of ~2.5 years

- Leverage Government Support: Utilize subsidies, loans, and tenders for maximum gains

- Invest in Sustainability: Convert agricultural and forest waste into valuable energy

1 review for Biomass Financial Feasibility Report

Add a review Cancel reply

Loading...

-

Company Formation

0 out of 5 0₹15,000.00Original price was: ₹15,000.00.₹12,000.00Current price is: ₹12,000.00. -

Punjab State Agri Warehouse E-Book

0 out of 5 0₹2,999.00Original price was: ₹2,999.00.₹1,999.00Current price is: ₹1,999.00. -

NABARD Subsidy For Agri Godown eBook

0 out of 5 0₹1,999.00Original price was: ₹1,999.00.₹1,499.00Current price is: ₹1,499.00. -

Biomass Subsidy Viability Report Hindi Version

0 out of 5 0₹1,999.00Original price was: ₹1,999.00.₹999.00Current price is: ₹999.00. -

Biomass Subsidy Viability Report (SvR)

4.00 out of 5 1₹1,999.00Original price was: ₹1,999.00.₹999.00Current price is: ₹999.00. -

Biomass Subsidy Viability Report Punjab State

4.00 out of 5 1₹1,999.00Original price was: ₹1,999.00.₹999.00Current price is: ₹999.00.

Product Enquiry

Biomass Financial Feasibility Report

Related products

-

Biomass Briquettes & Pellets eBook

5.00 out of 5 1₹999.00Original price was: ₹999.00.₹499.00Current price is: ₹499.00. -

Biomass Subsidy Viability Report Hindi Version

0 out of 5 0₹1,999.00Original price was: ₹1,999.00.₹999.00Current price is: ₹999.00. -

Biomass Briquettes & Pellets SvR Marathi Version

5.00 out of 5 1₹1,999.00Original price was: ₹1,999.00.₹999.00Current price is: ₹999.00.

Biomass

Biomass  Warehouse

Warehouse  Msme services

Msme services  Diary and Milk Processing

Diary and Milk Processing  Agro-Base Business

Agro-Base Business

Home

Home  Whishlist

Whishlist  Checkout

Checkout  Account

Account

Manreet Gill –

Good