-

GEM Registration

0Original price was: ₹5,000.00.₹3,500.00Current price is: ₹3,500.00.Available on backorder

Any business need to register with GEM portal to sell goods & services easily to government. GEM registration also ensures that sellers are authentic & credible. It provides real-time data & competitive pricing. Eligibility:- Sole Proprietorship Partnership Firms Limited Liability Partnership (LLP) Private Limited Companies Public Limited Companies Cooperative Societies State/UT-owned Companies Benefits of GEM Registration Access to Government Tenders Enhanced Visibility Easy and Transparent Procurement Process Simplified Payment and Delivery Terms Incentives for MSMEs Business Growth and Expansion Real-time Updates Integration with Digital Services Increased Credibility Access to Real-Time Data and Analytics Support for Exporters Special Note: – KIP provides many other services to our clients to grow easily like start up benefits that helps to grow their business and stability also. Like start up benefits, subsidies for many businesses, also helps to reach government tenders and many more benefits. Special benefits for accounting/ accounting supervision services with GST registration. -

GST Registration For Warehousing

0Original price was: ₹2,750.00.₹2,475.00Current price is: ₹2,475.00.Available on backorder

KIP4Business provides fast and reliable GST registration for warehousing businesses, ensuring full compliance, ITC benefits, subsidy support, and eligibility for government tenders. -

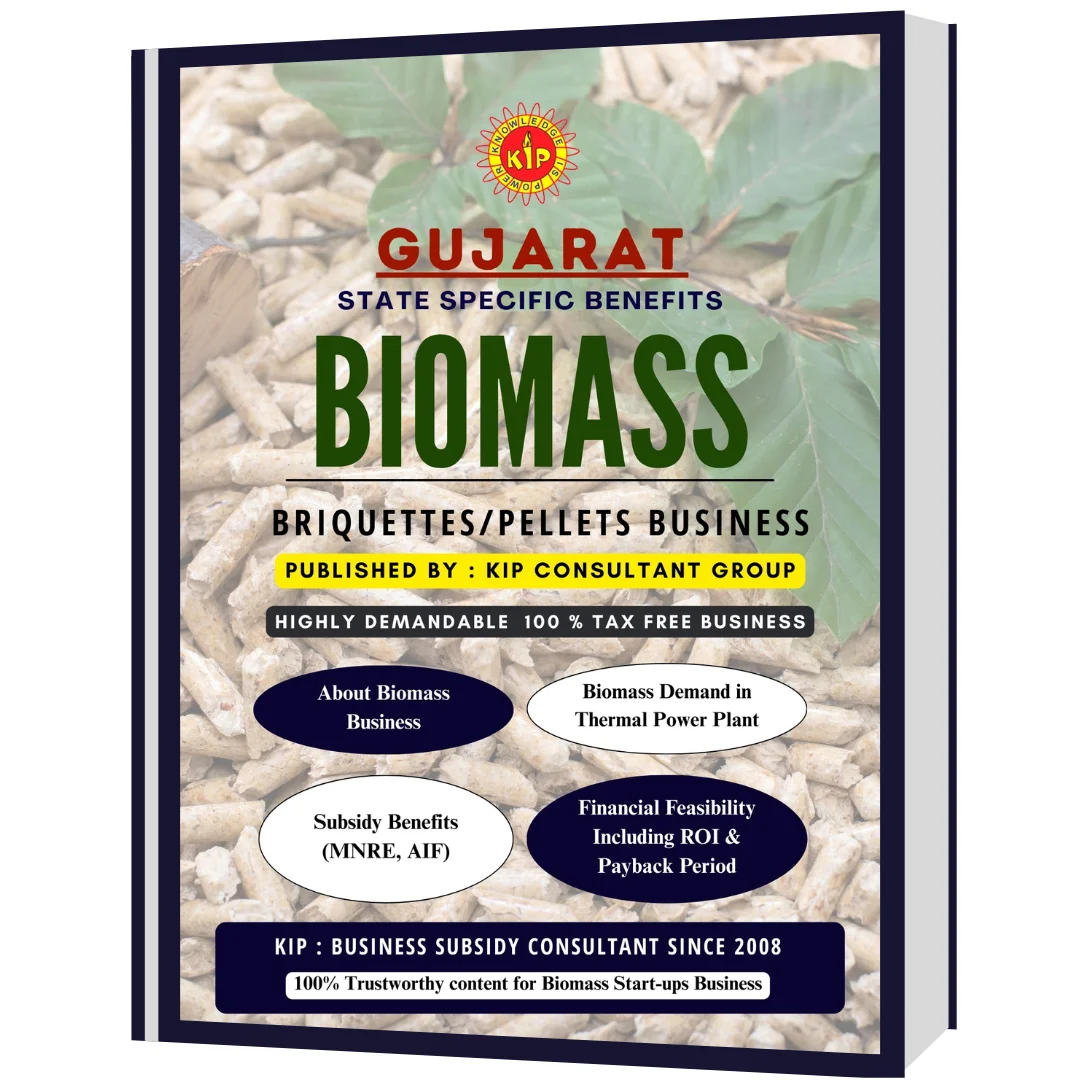

Gujarat Commercial Warehouse E-Book

0Original price was: ₹2,999.00.₹1,999.00Current price is: ₹1,999.00.Our SvR E-Book unlocks Integrated Logistics & Logistics Park Policy 2021 subsidies to maximize ROI & reduce costs. -

HAFED CAP Godown Construction Tender – 3 Years Guaranteed Lease (Haryana) Tender Overview HAFED invites eligible bidders for the construction and leasing of CAP (Cover and Plinth) Godowns for foodgrain storage under a 3-Year Guaranteed Lease Scheme. This tender follows the Build, Own & Operate (BOO) model or Lease-Only option, offering assured rental income backed by a government cooperative. This opportunity is ideal for landowners, warehouse developers, infrastructure companies, and logistics operators looking for stable, long-term returns through government-supported storage infrastructure. Key Highlights ✔ 3 Years Guaranteed Lease by HAFED ✔ Build, Own & Operate OR Lease-Only Option ✔ Minimum Capacity: 5,000 MT ✔ Multiple Capacity Slabs Allowed ✔ Tender Submission via GeM Portal ✔ Government-Backed Storage Requirement ✔ Stable & Predictable Rental Income ✔ Price Escalation Linked to WPI (LWS Only) Tender Chronology Activity Timeline Last Date of Bid Submission 02 February 2026 Mode of Submission GeM Portal (Online) Acceptance & LOI As per HAFED Schedule CAP Construction Period Within 60 Days Guaranteed Lease Period 3 Years CAP Capacity & Land Requirement Storage Capacity Approx. Land Required 5,000 MT 2.0 Acres Each Additional 5,000 MT +1.7 Acres Capacity must be applied only in multiples of 5,000 MT Bidders may apply for multiple capacities Who Can Apply Eligible Applicants ✔ Individual Landowners✔ Partnership Firms✔ Private / Public Limited Companies✔ Landholders under Registered Lease Deed✔ Warehouse Operators & Logistics Firms Land Ownership Criteria Land must be owned or held under registered lease Lease validity: Minimum 3–4 Years Construction permission for CAP mandatory Land acquisition allowed within 15 days after bid acceptance EMD & Security Deposit Details Earnest Money Deposit (EMD) ₹ 5 per MT Security Deposit ₹ 20 per MT Payable within 15 working days of acceptance Additional EMD (If Land Acquired After Allotment) ₹ 10 per MT Bank Guarantee valid for 6 months Land & Site Specifications No HT Line (11 KVA & above) over CAP layout Non-Encumbrance Certificate (NEC) or Undertaking Proper site sketch & layout plan All-weather motorable road access Preferably located near National / State Highway No truck movement restrictions Construction & Infrastructure Scope The bidder must develop a complete CAP Complex, including: CAP plinths & covers Internal & approach roads Office building Weighbridge Proper fencing (2m height, barbed wire) Drainage system Electricity & water supply Toilets & utilities Pricing & Rent Structure Rent quoted Per Quintal Per Month Price must include all costs & facilities No rent escalation for Lease-Only WPI-linked escalation applicable for LWS Normalisation Factor ₹ 0.065 per Quintal per Km (for price evaluation) Insurance Requirements Lease Only: Property insurance mandatory Lease with Services: Property + Stock insurance mandatory Entire cost borne by lessor Why Invest in This HAFED CAP Tender? ✔ Guaranteed government lease ✔ Low market risk ✔ Long-term assured income ✔ Scalable storage capacity ✔ Ideal for agro-infrastructure investors ✔ Backed by foodgrain procurement demand MANDATORY DOCUMENTS FOR TENDER ✔ Tender Application submitted on GeM Portal ✔ Land Ownership Proof / Registered Lease Deed ✔ Permission to Construct CAP Godown ✔ Non-Encumbrance Certificate (NEC) / Undertaking ✔ Site Layout / Sketch Plan of Land ✔ Undertaking for Removal of HT Line (if applicable) ✔ All-Weather Road Access Undertaking ✔ EMD Proof as per Applied Capacity ✔ Security Deposit Undertaking ✔ Identity Proof of Bidder / Authorized Signatory ✔ Partnership Deed / Company Incorporation Documents (if applicable) ✔ Experience Certificate (for Lease with Services option) ✔ Affidavit & Declarations as per Tender Conditions Terms & Conditions 1 Any other work shall be separately Charged. 2 Any work related expenses such as Tender Fee/EMD/Digital Signature(if applicable)/Stamp Papers/Mohar/Layout Map/PAN/Partnership Deed/Lease Deed/Power of attorney/Notarization/CA. Certification etc. shall be born by party itself. 3 Party need to ensure Complete Documentation as required for Tender Filling. 4 We at KIP, Shall not be liable for not submission of tender due to Non- Submission of Documents/Not Making EMD Payment/Technical Problem on Portal or any other external cause/causes which are not controlable. 5 Party need to ensure Payment Mode for EMD Money and timely deposit of it. 6 Party need to fix up Financial bid at their end. 7 Party need to keep updated himself for Portal Update after submission of Tender. We at KIP, shall not be liable to give update for any further communication for said tender. 8 If Client want to take any services after submission of tender then that will be separatly charged. 9 Our Professional fees are not refundable. Contact KIP Team For Tender Filling 8683898080 | 9017951780 KIP Financial Consultancy Pvt. Ltd.

-

Construction & Leasing of CAP Storage Facility for Food Grains – HAFED (Haryana) The Haryana State Cooperative Supply and Marketing Federation Limited (HAFED) has invited e-tenders through the GeM portal for the construction, ownership, and leasing of new Covered and Plinth (CAP) storage facilities for food grain storage. The project is offered under a Build, Own & Operate (BOO) model on Lease with Services or Lease Only basis, ensuring assured government-backed revenue. The selected bidder shall construct brand-new CAP godowns on owned or registered leased land (minimum 4 years validity) and lease them to HAFED for a guaranteed period of three (03) years. These facilities will be used for safe storage of food grains under the supervision of HAFED/FCI. Key Features & Scope of Work Project Type: Construction & leasing of Covered and Plinth (CAP) storage Contract Model: Lease with Services (Preservation, Maintenance, Security, Insurance) Lease Only (Infrastructure leasing without services) Guaranteed Lease Period: 3 Years Construction Timeline: Up to 60 days from Acceptance Letter Last Date for Tender Submission: 03 Feb 2026 Infrastructure & Technical Specifications Raised plinth with proper drainage and flood-safe elevation Brick masonry plinth walls with approved layout design All-weather motorable road connectivity Pit-less 40 MT electronic weighbridge Office building, internal roads, fencing, water & electricity supply CAP layout compliant with FCI & HAFED standards Storage designed for safe handling, stacking, and movement of food grains Eligibility Highlights Individuals, Partnership Firms, Companies, or Trusts Land ownership or registered lease (minimum 4 years) Option to acquire land within 15 days with supplementary bank guarantee Experience in food grain preservation (for lease with services) Non-blacklisted entities only Ideal For Warehouse developers & infrastructure investors Agri-logistics companies Landowners near highways or railheads Long-term, low-risk government-backed rental income seekers Locations : MANDATORY DOCUMENTS FOR TENDER 1. GeM Tender Form (duly filled & submitted online) 2. PAN Card of bidder 3. Proof of Land Ownership or Registered Lease Deed (minimum 4 years) 4. Jamabandi / Title Deed 5. Khasra / Survey Numbers with Site Sketch 6. Non-Encumbrance Certificate (NEC) 7. Layout Plan of Proposed CAP 8. Affidavit for Land Acquisition (if land to be acquired within 15 days) 9. EMD Payment Proof (₹5 per MT) 10. Supplementary Bank Guarantee (₹10 per MT, if land not owned) 11. Firm/Company Documents Partnership Deed / MOA & AOA / Incorporation Certificate 12. Last 3 Years ITRs or 1 Year Bank Statement 13. Bank Account Details of Bidder Terms & Conditions 1 Any other work shall be separately Charged. 2 Any work related expenses such as Tender Fee/EMD/Digital Signature(if applicable)/Stamp Papers/Mohar/Layout Map/PAN/Partnership Deed/Lease Deed/Power of attorney/Notarization/CA. Certification etc. shall be born by party itself. 3 Party need to ensure Complete Documentation as required for Tender Filling. 4 We at KIP, Shall not be liable for not submission of tender due to Non- Submission of Documents/Not Making EMD Payment/Technical Problem on Portal or any other external cause/causes which are not controlable. 5 Party need to ensure Payment Mode for EMD Money and timely deposit of it. 6 Party need to fix up Financial bid at their end. 7 Party need to keep updated himself for Portal Update after submission of Tender. We at KIP, shall not be liable to give update for any further communication for said tender. 8 If Client want to take any services after submission of tender then that will be separatly charged. 9 Our Professional fees are not refundable. Contact KIP Team For Tender Filling 8683898080 | 9017951780 KIP Financial Consultancy Pvt. Ltd.

- Image

- SKU

- Rating

- Price

- Stock

- Availability

- Add to cart

- Description

- Content

- Weight

- Dimensions

- Additional information

Biomass

Biomass  Warehouse

Warehouse  Msme services

Msme services  Diary & Milk Processing

Diary & Milk Processing  Agro-Base Business

Agro-Base Business  Business Registration

Business Registration  Tender Updates

Tender Updates

Home

Home  Whishlist

Whishlist  Checkout

Checkout  Account

Account