Investing in Punjab’s warehousing and logistics sector offers numerous strategic and financial advantages for entrepreneurs and companies:

Prime Location Advantage:

Punjab’s central position in North India provides easy access to major markets, trade corridors, and industrial hubs like Delhi, Haryana, and Himachal Pradesh.Strong Connectivity:

Excellent road, rail, and air connectivity through projects such as the Delhi–Amritsar–Katra Expressway and the Amritsar-Kolkata Industrial Corridor (AKIC) enhance logistics efficiency.Pro-Business Government Policies:

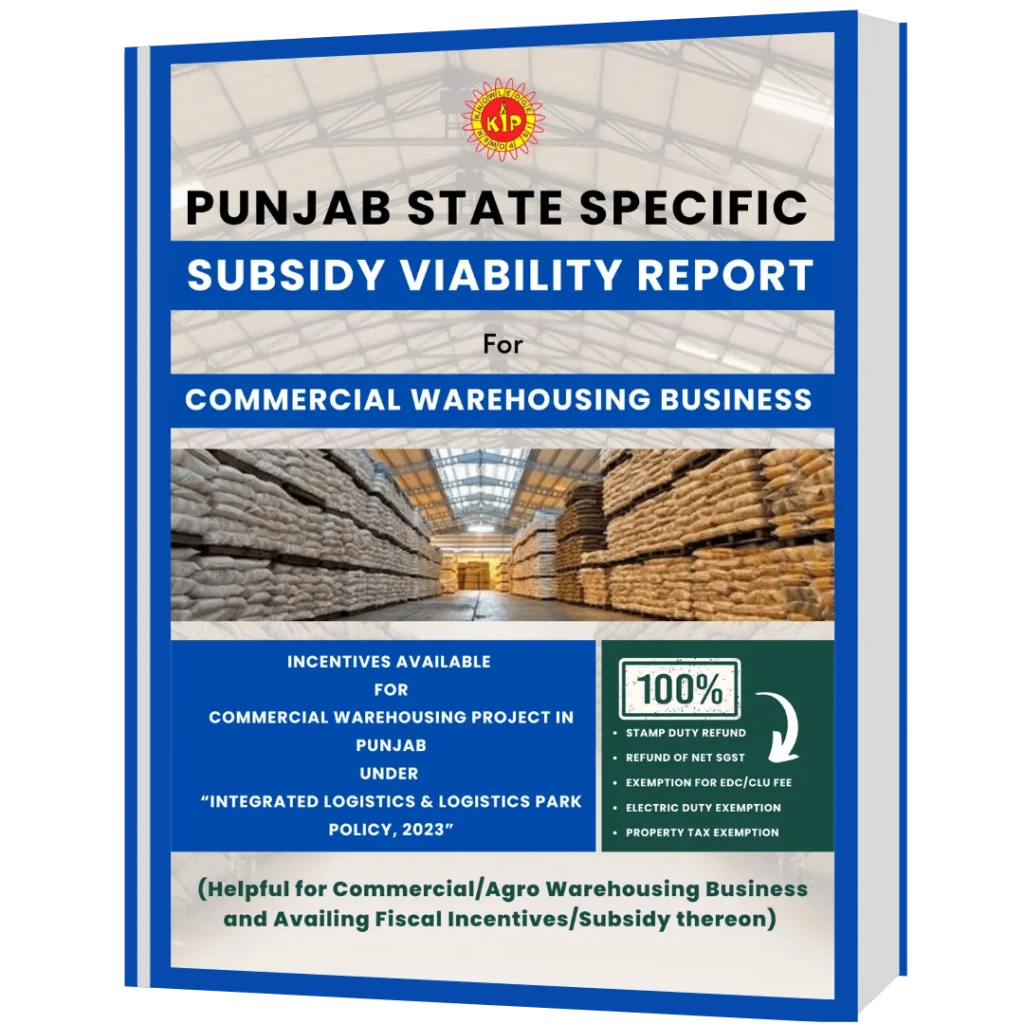

The Integrated Logistics & Logistics Park Policy 2023 ensures single-window clearance, investor facilitation, and long-term fiscal incentives.High Return on Investment (ROI):

Warehousing offers stable rental income, asset appreciation, and government-backed subsidies that significantly boost profitability.Growing Market Demand:

Rapid e-commerce expansion, industrial growth, and agricultural exports continue to increase the need for modern storage infrastructure across Punjab.

Biomass

Biomass  Warehouse

Warehouse  Msme services

Msme services  Diary & Milk Processing

Diary & Milk Processing  Agro-Base Business

Agro-Base Business  Business Registration

Business Registration  Tender Updates

Tender Updates

Home

Home  Whishlist

Whishlist  Checkout

Checkout  Account

Account