Starting a commercial warehousing venture in Rajasthan is a high-potential opportunity, thanks to the state's strategic location, logistics-friendly environment, and progressive policies. But turning this opportunity into a profitable investment requires more than just land and infrastructure—it demands structured financial planning and precise subsidy strategy.

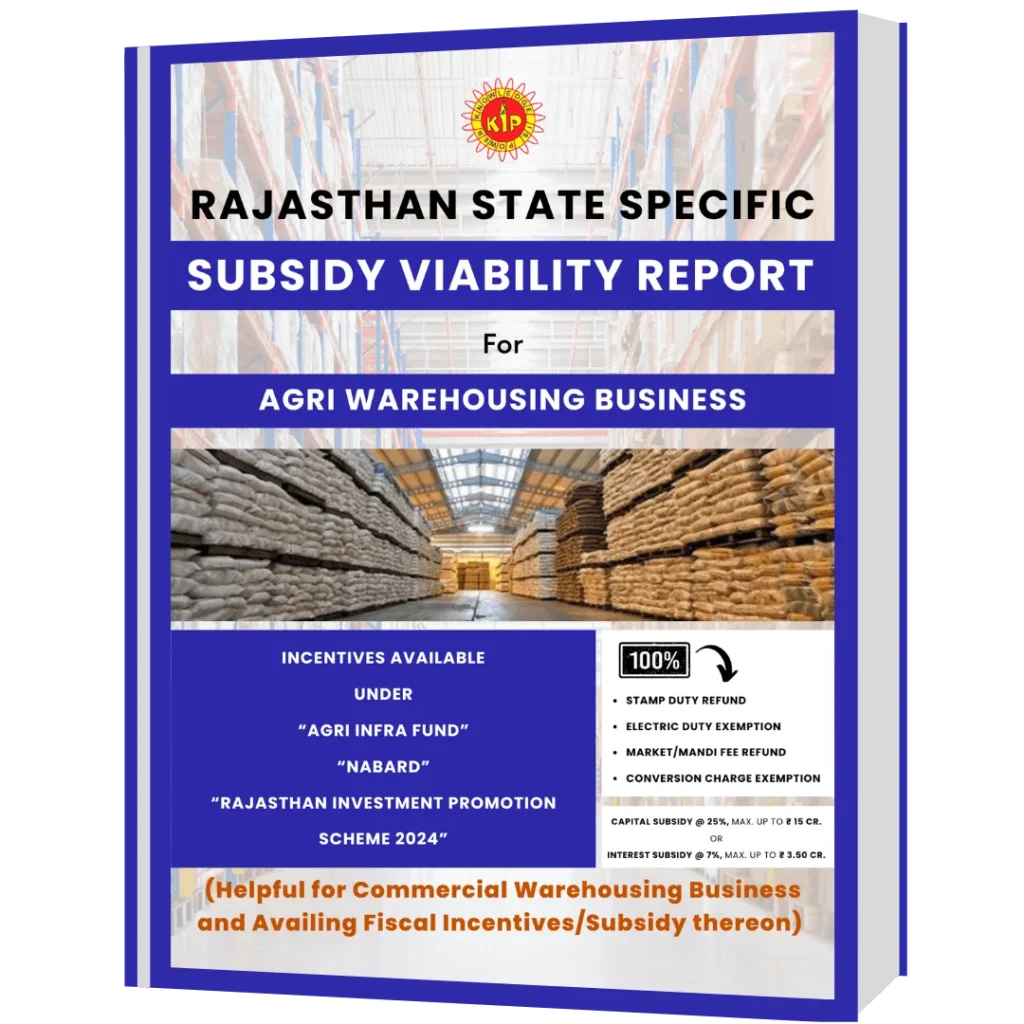

This is where the Subsidy Viability Report (SVR), especially the Rajasthan State-Specific Commercial Warehouse SVR, becomes a critical tool for warehouse developers, investors, and logistics businesses.

Below is a complete guide to understanding why the SVR matters under the Rajasthan Investment Promotion Scheme 2024 (RIPS 2024).

Biomass

Biomass  Warehouse

Warehouse  Msme services

Msme services  Diary and Milk Processing

Diary and Milk Processing  Agro-Base Business

Agro-Base Business

Home

Home  Whishlist

Whishlist  Checkout

Checkout  Account

Account