National Agri Infra Financing Facility

₹249.00 Original price was: ₹249.00.₹149.00Current price is: ₹149.00.

Helpful for all types of Agro-Based Business and Availing Fiscal Incentives thereon. This e-book has been specifically prepared for Businessman who are going to set up a New Business or planning to expand their business.

E-Book Title:

National Agri Infra Financing Facility

About This Essential E-Book:

Unlock the true potential of your agri-based infrastructure venture with this powerful, easy-to-follow guide:

“Easy Bank Finance & Interest Subsidy Under AIF.”

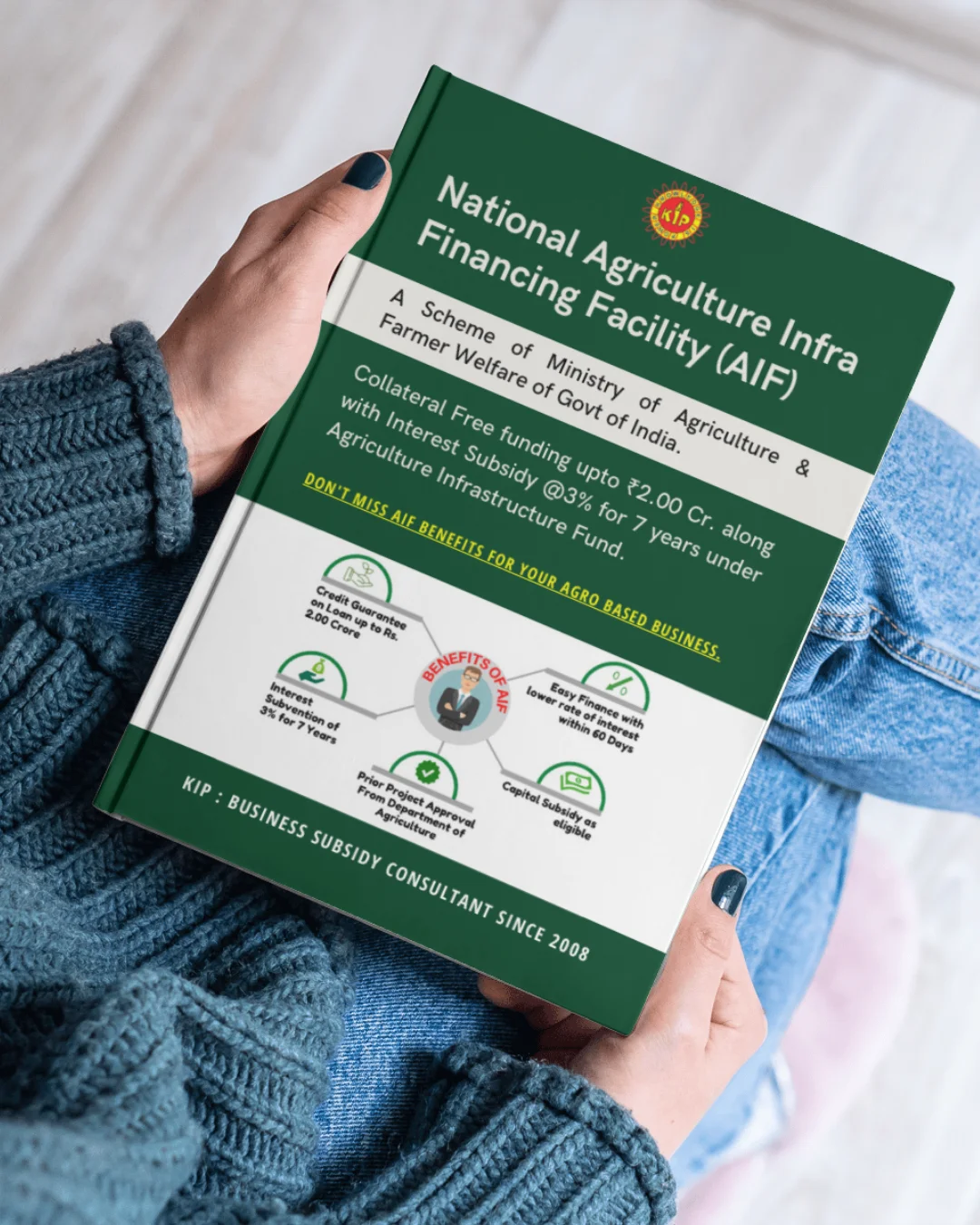

This eBook is your step-by-step companion to understanding and availing benefits under the Agriculture Infrastructure Fund (AIF) — a ₹1 lakh crore initiative launched by the Ministry of Agriculture & Farmers Welfare, Government of India.

Designed for business owners, investors, and entrepreneurs in the agriculture sector, this guide simplifies the complex processes of getting bank loans, interest subsidies, and credit guarantees — all in one place. It empowers you to reduce borrowing costs, access collateral-free funding, and maximize your subsidy benefits under AIF.

Who Should Use This E-Book?

This guide is ideal for:

- Agri-business owners planning to set up or expand infrastructure

- Investors optimizing business models in the agri-infra space

- Entrepreneurs in post-harvest, supply chain, or primary processing

- Individuals, Proprietorships, Partnerships, LLPs, Companies, FPOs, SHGs

- Anyone looking to secure loans up to ₹2 Cr without collateral

- Businesses facing challenges in accessing credit-linked subsidies

What You’ll Learn Inside:

About the AIF Scheme

- Overview of the ₹1 lakh crore government-backed fund

- Key objectives and ecosystem (linking government, banks, and businesses)

- How the scheme drives agri-infrastructure growth

Eligible Businesses Under AIF

Explore the wide range of projects that qualify:

- E-Marketing Platforms for agriculture produce

- Cold Storage, Warehousing, Grading & Packing Units

- Biomass & Waste-to-Energy Projects (Bio-CNG, Briquettes, etc.)

- Primary Processing Units for rice, sugarcane, jute, fruits, and vegetables

- Input & Equipment-Based Businesses (vermicompost, nurseries, tissue culture, etc.)

- Horticulture & Allied Agri Activities

- More than 20+ project categories supported

Eligibility Criteria

Understand who can apply:

- Individual Entrepreneurs

- MSMEs and Agri-Tech Startups

- Companies, LLPs, Partnership Firms

- FPOs, SHGs, PACS, Cooperatives

- Existing agri-units looking to modernize or expand

Key Benefits of the AIF Scheme

- 3% Interest Subvention on bank term loans (for up to 7 years)

- Collateral-Free Loans through Credit Guarantee (CGTMSE or Government-backed)

- Refund of Guarantee Fees for eligible units

- Faster Loan Processing under priority sector lending (typically within 60 days)

- Combine with Other Subsidies (State/Central) for maximum benefits

- Multi-Project Coverage: Avail AIF for up to 25 projects across different locations

- Retroactive Benefits: Eligible even if loan is already sanctioned

-

Rajasthan Commercial Warehouse E-Book

0 out of 5 0₹2,999.00Original price was: ₹2,999.00.₹1,999.00Current price is: ₹1,999.00. -

Animal Husbandry Infrastrucure Development Fund eBook

0 out of 5 0₹399.00Original price was: ₹399.00.₹199.00Current price is: ₹199.00. -

Company Formation

0 out of 5 0₹15,000.00Original price was: ₹15,000.00.₹12,000.00Current price is: ₹12,000.00. -

Biomass SVR Uttar Pradesh

5.00 out of 5 1₹1,999.00Original price was: ₹1,999.00.₹999.00Current price is: ₹999.00. -

Biomass Subsidy Viability Report (SvR)

4.00 out of 5 1₹1,999.00Original price was: ₹1,999.00.₹999.00Current price is: ₹999.00. -

Biomass Briquettes & Pellets eBook

5.00 out of 5 1₹999.00Original price was: ₹999.00.₹499.00Current price is: ₹499.00.

Product Enquiry

Related products

-

Animal Husbandry Infrastrucure Development Fund eBook

0 out of 5 0₹399.00Original price was: ₹399.00.₹199.00Current price is: ₹199.00. -

Agriculture Infrastructure Fund eBook

0 out of 5 0₹199.00Original price was: ₹199.00.₹99.00Current price is: ₹99.00. -

Haryana Gramin Udyogik Vikas Yojna

0 out of 5 0₹499.00Original price was: ₹499.00.₹199.00Current price is: ₹199.00.

Biomass

Biomass  Warehouse

Warehouse  Msme services

Msme services  Diary & Milk Processing

Diary & Milk Processing  Agro-Base Business

Agro-Base Business  Business Registration

Business Registration  Tender Updates

Tender Updates

Home

Home  Whishlist

Whishlist  Checkout

Checkout  Account

Account

Reviews

There are no reviews yet.